Tax Clinic:

Contact Tax Clinic

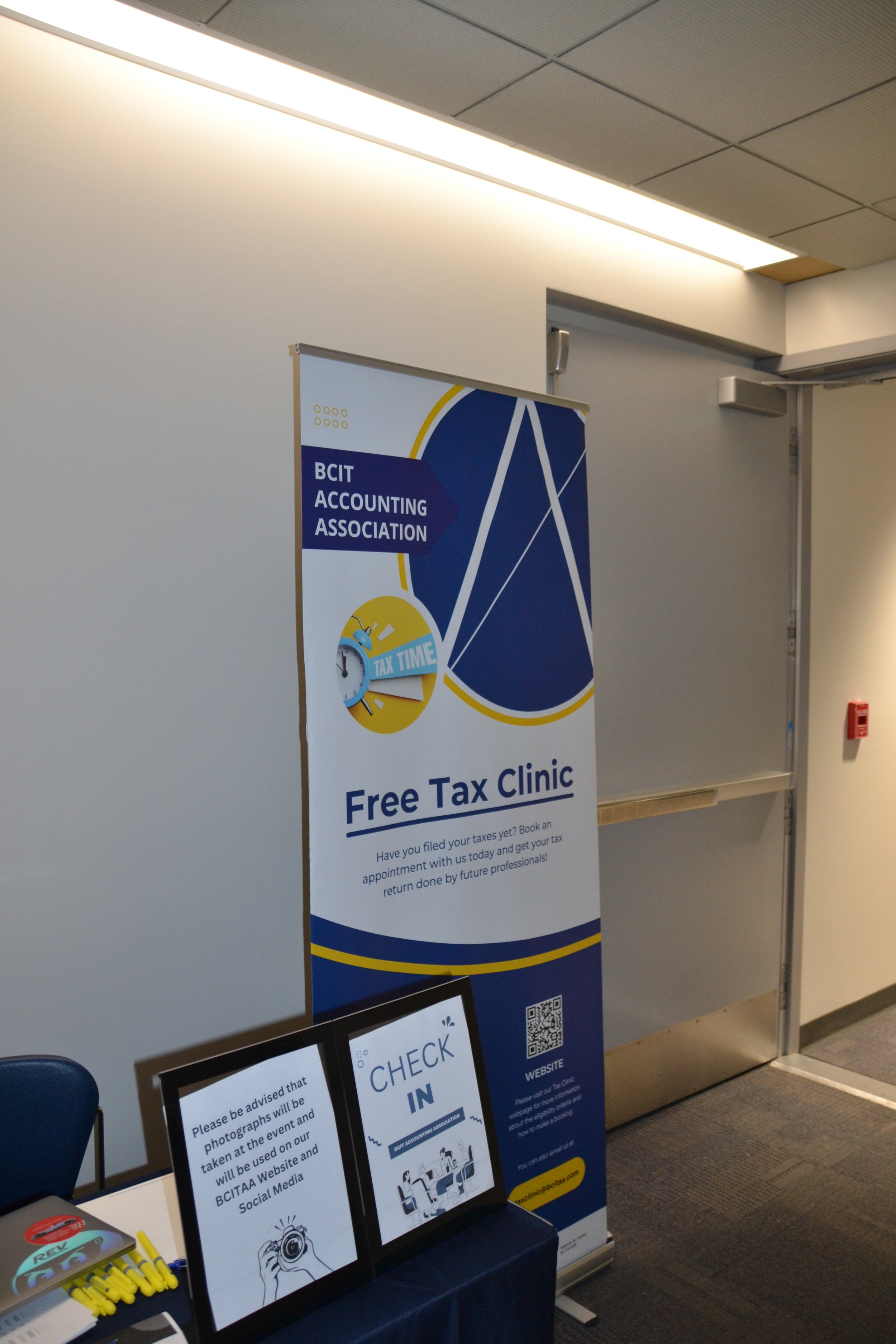

Our biggest event is the free tax clinic which is a service offered by future professionals to assist individuals with their tax preparation and filing, at no cost to the client. These clinics are organized with the help of the CVITP (Community Volunteer Income Tax Program) with the aim of providing accessible tax assistance to those who may not have the resources to pay for professional tax services.

Volunteers who participate in helping the community file their taxes and walk away with certifications given out by the CRA (Canada Revenue Agency) for their contribution to this volunteer program.

Free Tax Clinic 2025 Registration

Are you ready to have your taxes done by our future professionals? 🎓🧾

Register now to book your appointment with us! Our 2025 Free Tax Clinic will take place on the following dates and locations:

Downtown Campus: 555 Seymour St, Vancouver, BC V6B 3H6

📅 April 2nd

🕒 3:00 PM – 6:00 PMBurnaby Campus: 3700 Willingdon Ave, Burnaby, BC V5G 3H2

📅 April 4, 11 & 16th

🕒 3:00 PM – 6:00 PM

Are You Eligible to Have Your Taxes Done by Us?

You may qualify for our services if:

You have no income, or

Your income comes from the following sources:

Employment

Pension

Benefits (e.g., Canada Pension Plan, Old Age Security, disability insurance, employment insurance, or social assistance)

Registered Retirement Savings Plans (RRSPs)

Scholarships, fellowships, bursaries, or grants

Interest income (under $1,000)

Exclusions

You are not eligible for our services if you have:

Self-employment income or employment expenses (e.g., driving for Lyft/Uber)

Business income or expenses

Rental income or expenses

Interest income exceeding $1,000

Capital gains or losses

Bankruptcy

A deceased person's tax return to file

Foreign property or foreign income

Eligibility for the Public

To qualify for the CVITP (Community Volunteer Income Tax Program), individuals must have modest income and a simple tax situation. Eligible individuals may include:

Adults aged 65 years and older

Housing-insecure individuals

Indigenous peoples

Modest-income individuals

Newcomers

Persons with disabilities

Students

Modest Income Guidelines

Family Size

Total Family Income

1 person $35,000

2 people $45,000

3 people $47,500

4 people $50,000

5 people $52,500

More than 5 people $52,500 + $2,500 for each additional person

Modest income means the total family income is less than the amounts listed above. Family size includes an individual, a couple, and their dependents.

LINK TO BOOK AN APPOINTMENT

If you have any questions or concerns, please contact us at taxclinic@bcitaa.com.

Become a Tax Preparer or Support Role for our upcoming Tax Clinic 2025

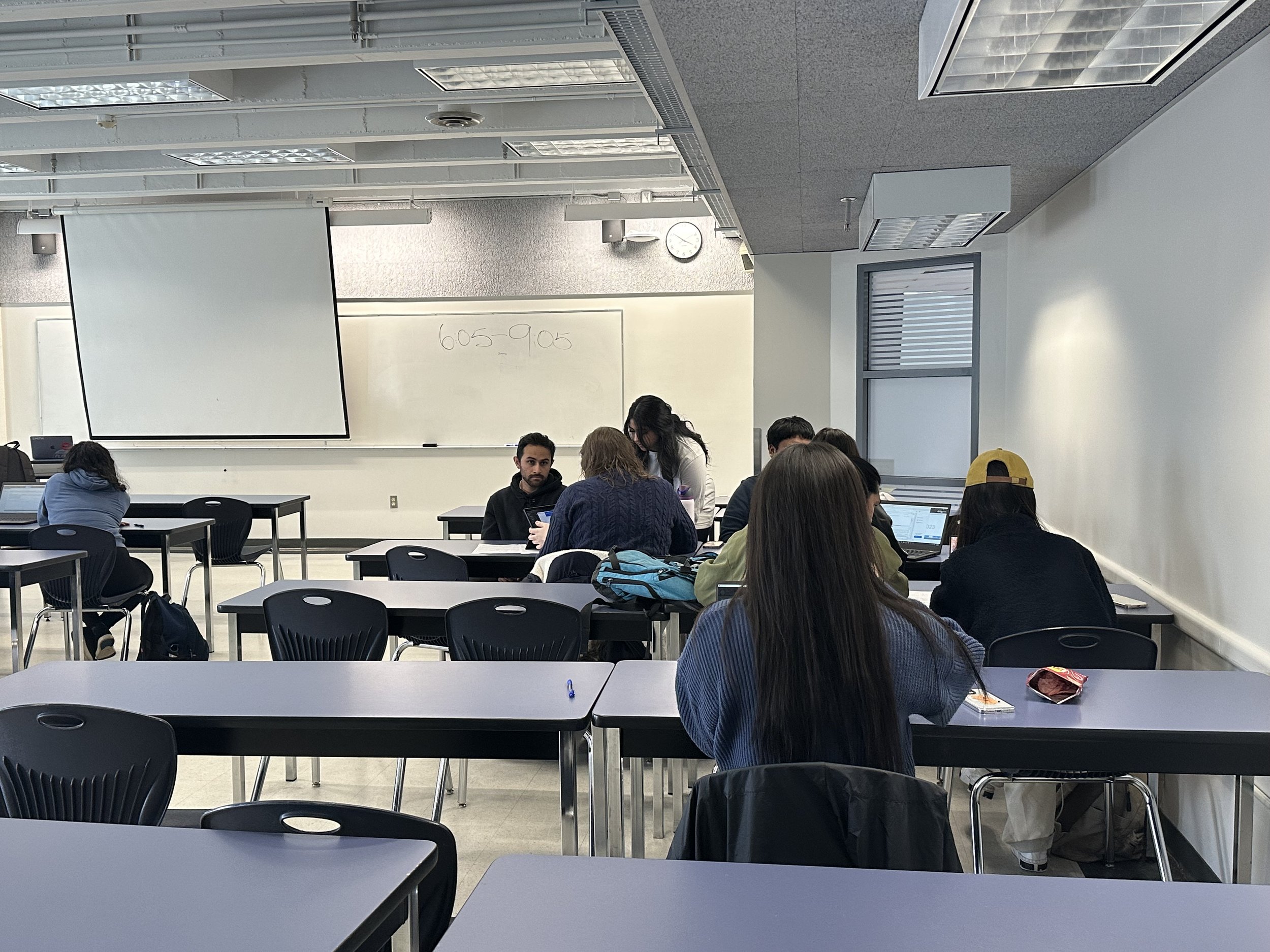

Looking to gain valuable experience for your resume? The BCIT Accounting Association is hosting Tax Clinics on April 4th, 11th, and 16th at the Burnaby Campus, and on April 2nd at the Downtown Campus. We invite you to join as a volunteer, either as a tax preparer or in a support role.

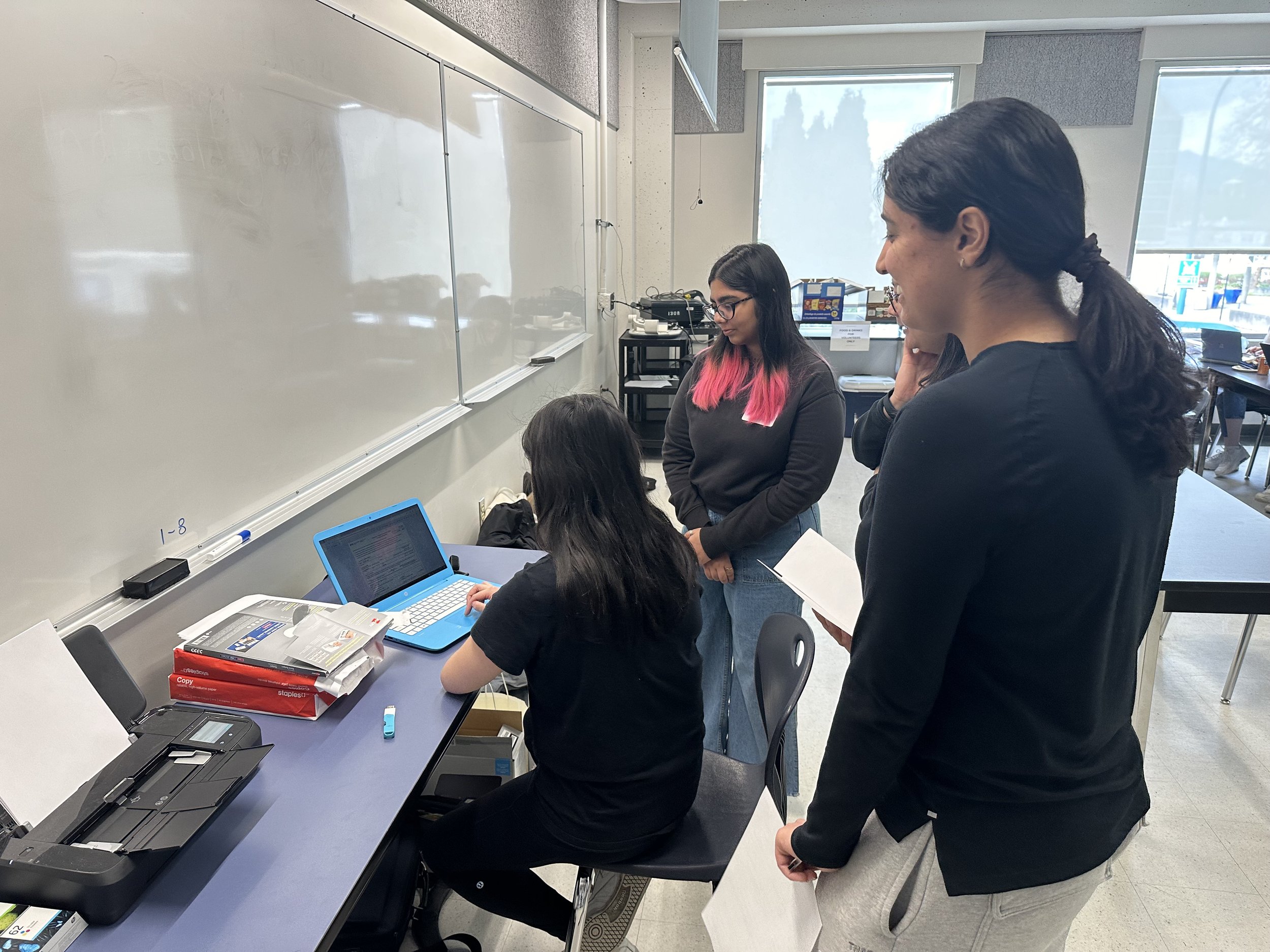

As a tax preparer, you will learn to prepare and file tax returns electronically, assisting individuals with modest incomes and simple tax situations. You will be helping fellow students, low-income families, seniors, and others in need. No prior tax experience is required—mandatory in-person training for tax preparers will be held on March 19th from 3 PM to 5 PM at the Burnaby Campus.

To qualify as a tax preparer, you must meet the following requirements:

Filed your taxes last year

Your visa must not expire before December 31st, 2025

In the support role, you will assist by ensuring taxpayers have the necessary paperwork, organizing documents, and being the first point of contact. You will also help tax preparers print important documents. There are no requirements for the support role.

Not only will this opportunity look great on your resume, but all volunteers will receive a CRA certification and a free lunch. To sign up, please register for either the tax preparer or support role through the links below.

If spots are full, please still register, and you will be added to the waitlist.

Registration closes on February 17th at 11:59 PM.

If you register but are no longer able to participate, please email Vy at vy@bcitaa.com before February 11th.

Tax Clinic 2024

Thank you…

To our Volunteers!

Karamdeep Kaur, Winnie Zhu, Kevin Troung, Stephanie Lui, Harjot Ramgarhia, Hind Al-Abbasi, Debroah Xu, Soliana Telezion, Gurkaran Mangat, Subhan Elahi, Linden Tham, Jon Wearing, Daniel Moran, Sanaz Kazemi, Arash Zamanishiahkal, Yaya Su, Elka Lepardo, Nathan Yatco, Yossaral Charnkhuang, Kimberly Choi

Anveet Brar, Adrian Yu, Briley Nguqyen, Christina McDonald, Dongmin Hwang, Derek Yeung, Elijah Tu, Emma Courtney, Michael Dones, Quinn Jurgens, Rakiia Lolieva, Bobby Cutler, Suran Ma, Tomi Zlomislic, Yooni Lee, Vridhi Bhutani, Chelsea Lee, Iris Leung, Olga Troinikova, Vivian Nguyen, Puneet Bhathal, Jasmani Sanghera

Ailyn Suelto, Ainsley Moniz, Alex Hocevar, Masami Park, Bonnie Rong, David Stewart, Gabrielle Du, Jeevan Sidhu, Johanna Mataag, Joravar Aujla, Jacky Lun, Tim Mo, Matthew Ueda-Avarvarei, Melissa Reyes, Sonit Bhatia, Stacy Kissie, Tristan Huang, Lisa Chen, Ethan Liu, Isabella Jimenez, Jaskaran Sahota, Helen Nguyen, Aaliyah Arcalas, Sneha Sneha

Eilshye Quejado, Evan Darts, Kevin Manalc, Mariyam Nayeem, Matthew Ueda-Avarvarei, Matthew Ma, Michel Belouni, Navdeep Gill, Nimrat Bhangu, Rodneil Ong, Sowon Lee, Sharan Kaur, Tenzin Tseten, Harjot Ramgharia, Vincent Fu, Xavier Delaney, Jaskaran Sahota, Harleen Grewal, Amy Cho, Morgan Vu, Stella Chen, Gabriel Chee, Anne Dai

and our Accounting Association Club Members!

Lauren Aimar, Amy Kim, Piyanshu Gumber, Jason Law, Aruzhan Basbulat, Mira Dhari, Komal Bhangu, Jasmine Li, Aya Oijma, Leana Cao, Dennis Jiang, Chesey Gonzalex, Alex Bulbrook, Gurveer Dhaliwal

Lastly, a special thank you to our Tax Clinic Coordinators!

Tiyana O’Dwyer & Caitlyn Cheung

Tax Clinic 2024 Eligibility

Are you qualified to get your taxes done by us?

Individuals who have no income or if their income comes from these sources

Employment

Pension

Benefits, such as the Canadian Pension Plan, Old Age Security, disability insurance, employment insurance, and social assistance

Registered Retirement Savings Plans (RRSPs)

Scholarships, fellowships, bursaries, or grants

Interest (under $1,000)

Exclusions:

self-employment income or employment expenses

I.e. Driving for Lyft/Uber

business income or expenses

rental income and expenses

interest income over $1,000

capital gain or losses

bankruptcy

deceased person

foreign property/income

Filling Eligibility for the Public

To be eligible for the CVITP, individuals must have a modest income and a simple tax situation. This may include:

adults 65 years and older

housing-insecure individuals

indigenous peoples

modest-income individuals

newcomers

person with disabilities

students

Modest Income

Family Size Total family income

1 person $35,000

2 people $45,000

3 people $47,500

4 people $50,000

5 people $52,500

For more than 5 people $52,500 plus $2,500 for each additional person

(A modest income means the total family income is less than the amount shown above. Family size includes an individual, or a couple, and their dependents.)

IF YOU QUALIFY WE WILL BE HOSTING OUR TAX CLINIC ON THE FOLLOWING DATES:

Downtown Campus

April 2nd at 3-6 PM, Room: 465

Burnaby Campus:

April 3rd at 3-6 PM, Room: SE06 #202

April 10th at 3-6 PM, Room: SW01 #2004

April 17th at 3-6 PM, Room SW01 #2010

To book an appointment please email taxclinic@bcitaa.com and allow up to 48 hours for a response!

Become a tax preparer or support role for the upcoming Tax Clinic 2024!

Looking for experience to put on your resume? Look no further! The BCIT Accounting Association is hosting the Tax Clinics on April 3rd, 10th and 17th on the Burnaby Campus and April 2nd on the Downtown Campus. Join our Tax Clinic as a Volunteer to be a tax preparer or support role.

A tax preparer will learn how to prepare and file tax returns electronically. You will be preparing taxes for people with modest incomes and simple tax situations. In addition, you will be helping our fellow students as well as low-income families, seniors, and others in need. You do not need to have experience in doing taxes to sign up. We will be hosting a mandatory in-person training session on March 20th from 3pm to 5pm located on the Burnaby Campus only for the tax preparers.

To qualify as a tax preparer, you must have all the following:

-Filed your taxes last year

-Visa does not expire before Dec 31st, 2024

In the support role, you would have the opportunity to ensure taxpayers have the required paperwork and organize documents. Also, have a vital role by being the first point of contact for the public as well as supporting the tax preparers in printing out important, sensitive documents. There are no restrictions for registering in a support role.

Besides putting this opportunity on your resume, you will receive a CRA certification for volunteering your time at the Tax Clinic for all our volunteers. We will also be offering a free lunch for all of our volunteers. You must register with us for either being a tax preparer or a support person.

You must register to let us know you are interested. There are two links one for the tax preparer and support role. Once registered, our team will reach out by email to confirm the details of your application.

Link for the Tax Preparer Role

Link for the Support Role

If the spots are full, please still register as you will be put on a waitlist.

The deadline to register is Feb 4th at 11:59pm.

If you registered for the event but no longer wish to participate, please email Tiyana at tiyana@bcitaa.com before Feb 4th.

TAX CLINIC 2023

Thank You

To Our Volunteers…

Aaron Yu Yang Meng, Adrian Banan, Alexandra Pavlenco, Alphonse Royer, Amanda Xu, Anna Nguyen, Aruzhan Basbulat, Cassey-Leigh Craige, Chatchada Poonead, Chelsey Jimenez Gonzalez, Cody Johnston, Daniel Ajay Patrick, Dennis Jiang, Edven Poon, Ethan Liu, Gabriel Auraha, Gary Wong, George Qian, Gordon Zhou, Gurjot Hans, Gursimer Khera, Han Hang Xiao, Hanna Tesfa-Michael, Harjot Ramgarhia, Harleen Kaur Grewal, Heather Muirhead, Heidi Wan, Hojun Lee, Jackie Huang, Jacob Letwin, Janice Canela, Jaskaran Singh Luthra, Jenny Sebin Yun, Jiajia Wang, John Rhex Timbao, Joshua Lau, Justin Fung, Kayle Corinth Tabuzo, Kimberly Choi, Kirk Gabrillo, Komal Bhangu, Lauren Aimar, Lisa Chen, Madison Parker, Manjot Grewal, Mankirat Bhandal, Marco Chun Wing Lei, Mary Therese Delos Santos, Matthew Ma, Maya Khera, Mira Dhari, Mohammed Janab, Monika Monika, Naomi Chavez, Nicholas Dale, Nicholas Waslen, Nimcy Gautam, Owen Li, Paul Hu, Piyanshu Gumber, Poorva Bakhshi, Raghbir Sandhu, Rahul Marria, Ruby Chia Hsu, Ruthmila Kashem, Sahijveer Sidhu, Selena Fu, Shreya Shreya, Simran Anand, Sophie Minh Ngoc Pham, Sunny Xia Yang Huang, Sunyoung Choi, Thi My Ngoc Nguyen, Vincent Wen Xi Liu, William Kim, Xiaolan Zhu, Zhaoqi Wu